THE FEDERAL TRADE COMMISSION recently announced a settlement with a Houston based mortgage lead generator to pay a $225,000 fine for deceptive and misleading conduct. The company operates several websites targeting mortgage borrowers.

THE FEDERAL TRADE COMMISSION recently announced a settlement with a Houston based mortgage lead generator to pay a $225,000 fine for deceptive and misleading conduct. The company operates several websites targeting mortgage borrowers.

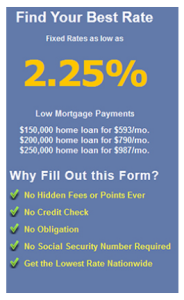

In the complaint filed by the FTC the Texas based company was alleged to have advertised Adjustable rate mortgage rates as Fixed and failed to disclose other required information such as APR and the true costs of loans being offered on their sites.

The problem of misleading advertising in the mortgage business has been a persistent issue for many years and has proliferated with the internet.

It’s nice to see the FTC is finally cracking down on the most egregious violators such as this company that were attempting to lure borrowers with unbelievably low interest rates. But is a $225,000 fine enough to stop these types of operators?

This company offers live transfer leads to mortgage originators. A live transfer lead is a term used to describe when a prospect calls an 800 number on the lead providers website and the call is transferred to a loan originator for an immediate contact and sales opportunity with the prospect.

This type of lead generally yields the highest rate of sales for the originator and earns the highest level of payment for the lead provider. It is not uncommon for live transfer lead providers to charge upwards of one hundred dollars for each live transfer lead. It is reasonable to assume that this company needed to generate less than 2,500 of these live transfers in order to pay their fine. My guess, is that they generated a lot more than 2,500 leads from their numerous websites.

In my opinion, this fine is nothing more than a slap on the wrist and will do nothing to deter companies like this from continuing their illegal behaviors.

The laws surrounding mortgage advertising have toughened in recent years but are still open to deceptive practices. There are numerous factors that are considered in determining the interest rate a borrower will pay. These factors are all loop holes that a lender can use as an excuse when offering bait and switch tactics.

The basics of the law are that when a lender advertises an interest rate, they must be able to prove that the rate offered, was available on the particular date that the ad was setup. Not that the rate was available to all borrowers, just that it was available. Lenders must also advertise an Annual Percentage Rate (APR) along with any rate offered in their advertising. The APR is a calculation that includes certain fees associated with obtaining the loan and is intended to show the consumer the true cost of the loan.

EXAMPLE: From the FTC Complaint ftc.gov/system/files/documents/cases/140508goloanscmpt.pdf

The bottom line is that advertised rates are seldom a reliable indicator of the rate you may ultimately be able to obtain. They should never be used as a deciding factor in determining your choice of a mortgage lender but as a guide to what you may be able to obtain from a particular lender if the stars all align and the rate advertised is appropriate to your circumstances.

Guy Benjamin (CAL BRE License #01014834, NMLS 887909) writes a weekly column for The Herald, offering general information on real estate matters. As it is impossible to address all possibilities and variations, he will try to answer individual questions by readers who contact him at 707-246-0949 or gbenjamin@rpm-mtg.com.

Leave a Reply